Life Insurance in and around Los Angeles

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Arizona

- California

- Nevada

- Texas

Your Life Insurance Search Is Over

One of the greatest ways you can protect the ones you hold dear is by taking the steps to be prepared. As weary as considering this may make you feel, it's a great idea to make sure you have life insurance to prepare for the unexpected.

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

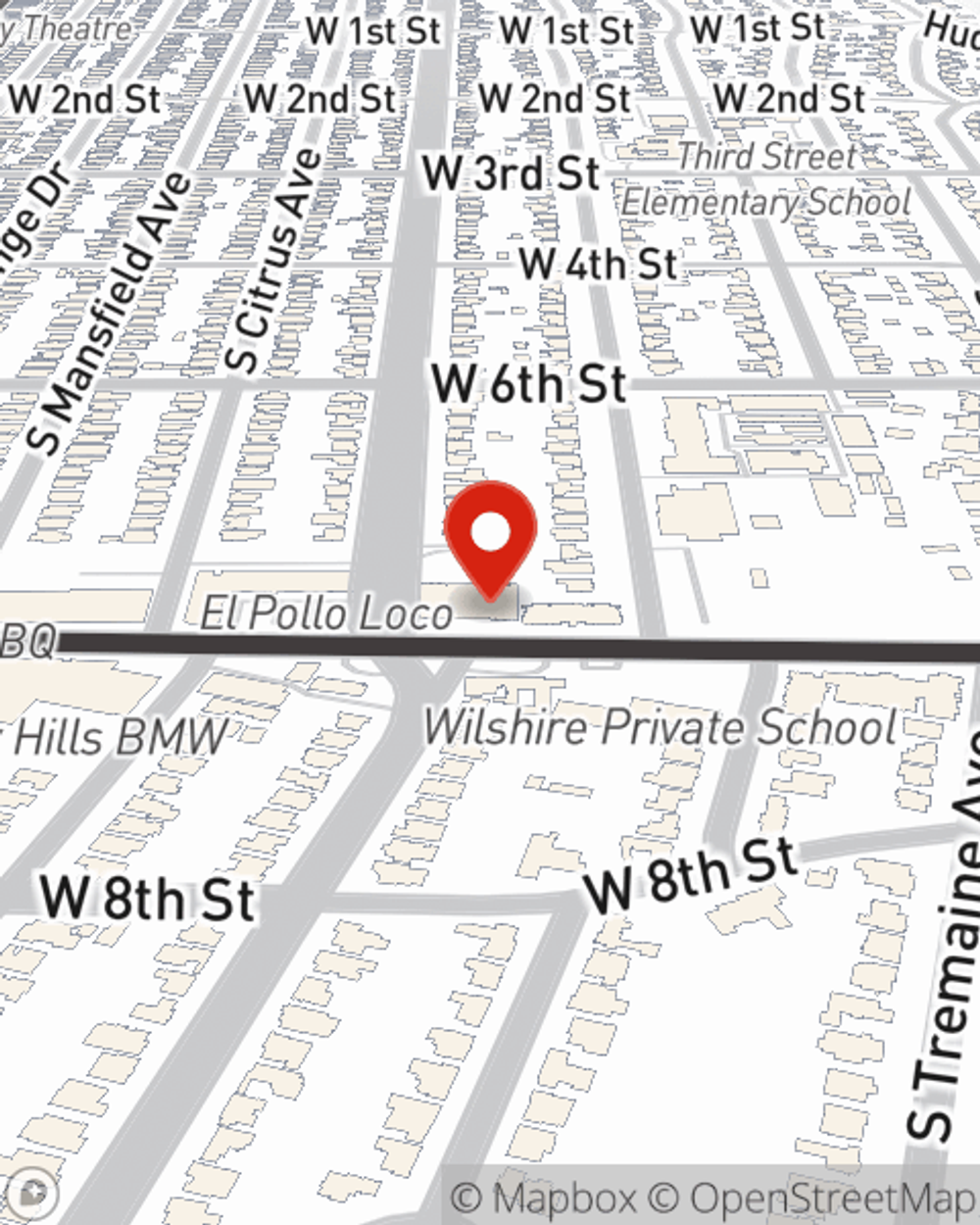

Agent Charles Garrett Jr, At Your Service

Having the right life insurance coverage can help loss be a bit less debilitating for the people you're closest to and give time to recover. It can also help cover matters like childcare costs, rent payments and phone bills.

With reliable, caring service, State Farm agent Charles Garrett Jr can help you make sure you and your loved ones have coverage if life doesn't go right. Call or email Charles Garrett Jr's office today to discover the options that are right for you.

Have More Questions About Life Insurance?

Call Charles at (323) 692-0090 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Charles Garrett Jr

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.